Frequency And Severity Insurance. They are modeled by the Loss Distribution Approach. Low Frequency Low Severity 2. Insurance companies base their estimations of claim frequency and severity on their own historical claims data. This example illustrates the use of Poisson Gamma and Tweedie regression on the French Motor Third-Party Liability Claims dataset and is inspired by an R tutorial 1.

Severity risks are risks of losses of very important but very few amounts. The frequency and severity band the zip code is assigned to the rate for the band is shown in Section 1 the raw or not credibility adjusted data is the data an insurer would use to combine with their own data if their own data was not 100 credible and they elected to follow the directions in Section 26329d2B as opposed to Section 26329d2A. In nonlife insurance frequency and severity are two essential building blocks in the actuarial modeling of insurance claims. For instance the frequencyseverity model is more flexible in the modeling of the occurrence and the size of insurance claims. In this paper we propose a dependent modeling framework to jointly examine the two components in a longitudinal context where the quantity of interest is the predictive distribution. For some data we observe the claim amount and think about a zero claim as meaning no claim during that period.

RShiny - Frequency Severity Insurance Claims Simulation - YouTube.

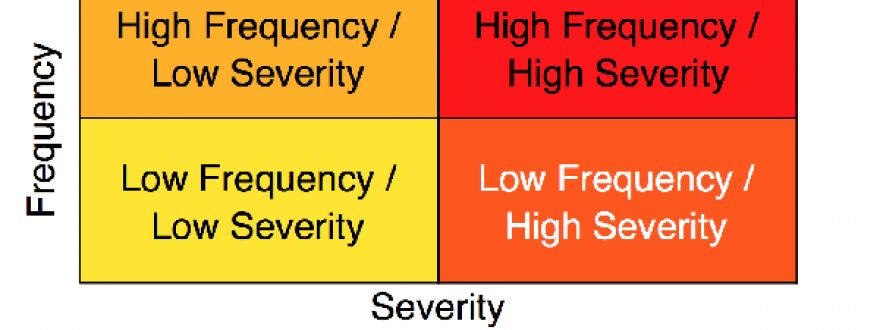

The management with the guidance of actuaries ensures that the insurance. Severity risks are risks of losses of very important but very few amounts. A contract within an insurance company and an individual policyholder. Frequency risks are defined as potential loss of low but frequent amounts. However a series of recent empirical studies have shown that the dependence between frequency and severity in auto insurance is statistically significant 4 5. Frequency and severity of claims are two of the things that insurance carriers look at when determining a customers rates.